Contents:

When creating a progress invoice out of an estimate, you need to specify how much you want to charge on the invoice for the selected items. Batch invoicing allows you to create invoices in bulk from a single-entry input, saving you time and effort. If you have multiple clients who are billed on a monthly basis for similar ongoing services, then you can create all of their invoices at once. What’s more, you can set up a new approval workflow by clicking on Setup Approval Process under the Company menu. You must sign up as an admin to be able to set up a workflow. As you see from the chart above, QuickBooks Enterprise is as powerful as QuickBooks Online in terms of banking, A/P, and A/R.

- He currently writes an agriculture-oriented QuickBooks blog at QBAgCenter.com.

- Download the files the instructor uses to teach the course.

- To do this check out the below steps.First, go to the Accountant menu, and click on Manage Fixed Asset.

- Managers can write depreciation off as a business expense, thereby reducing their taxes.

- We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries.

There are no plans to integrate with QuickBooks desktop, however, it can be used ‘stand-alone’ where fixed asset purchases can be added manually or imported using an Excel template. With nettTracker in place, many ‘year-end’ tasks relating to fixed assets are eliminated completely. The asset register is already up-to-date, deprecation calculated, and all journal entries have been made. The General Ledger account has all the transactions whether you pay or receive any amount in your account. So it helps you in tracking the depreciation of the assets that are the expenses in the General Ledger account. So it is important to add it for Fixed Asset Manager.

How To Fix The Wrong Depreciation Amount That Appears In The QuickBooks Column While Posting Journal Entries?

A Fixed Asset is an item on a company’s Balance Sheet — the tangible property used in the business and that is notfor resale. This would include buildings, furniture, fixtures, equipment, leasehold improvements and vehicles. Depreciation adjustments are recorded to expense the cost of these assets over their useful life. If fixed assets are a significant part of your business, then you need a scalable fixed asset management system that can help you accurately manage your asset information. QuickBooks Desktop Enterprise has a robust Fixed Asset Management system that can help you track physical assets, such as computers and machinery. Followed by selecting the type of assets to save to the fixed asset item list in QuickBooks and then click on next.

Fixed Assets Manager Software Reviews, Demo & Pricing — 2023 — Software Advice

Fixed Assets Manager Software Reviews, Demo & Pricing — 2023.

Posted: Wed, 27 Sep 2017 02:19:44 GMT [source]

This feature helps you gain complete control over the purchases made within your businesses. For instance, you can designate a team member as an approver of A/P transactions and track the status of each transaction that requires approval. QuickBooks Desktop Enterprise’s base plan, Silver, costs $1,410 per year for one user.

What is a Fixed Asset in QuickBooks Online?

You’ve already chosen Fixed Asset as the Type, so your cursor should be in the Asset Name/Number field. Enter an easy-to-recognize name so that you’ll be able to quickly identify it in reports. Select the correct Asset Account and type a description in the Purchase Description field, clicking the correct button for new or used. Much of the work you do in QuickBooks is short-term. Your purchase order is fulfilled, and the products move into your inventory. You run payrolls and submit their related taxes and other payments.

- If you have multiple clients who are billed on a monthly basis for similar ongoing services, then you can create all of their invoices at once.

- Choose Fixed Asset, then complete the information required.

- Another advanced feature to be considered is Fixed Asset Manager.

- Manage orders, approvals, and expenses in Precoro and automatically sync all the data with QuickBooks for accounting with our direct integration to QBO.

Followed by selecting the account and hitting OK button. Under the To QuickBooks tab, select Manually by selecting “Save Assets to QuickBooks” from the QuickBooks menu. On the From QuickBooks tab, select Manually by selecting “Update Assets from QuickBooks” in the QuickBooks menu.

Accounting & Tax

The fixed asset movements for an entire year could be dealt with at the same time. Finally, create an expense account to track depreciation expense. Give the account a name such as Depreciation Expense. The QuickBooks Point of Sale multi-user issues arises when users are trying to access a company file that is available …

It’s important for businesses to track and understand the real asset value of their company in order to get a complete picture of how their business is performing. Information from your QuickBooks Desktop company file will automatically go to your FAM the first time you set it up. The two applications will continue to sync depending on the sync set up that you choose on your FAM.

To set up fixed asset manager in QuickBooks it is easy for you to manage all the assets, depreciation, and many other things easily. It’s important that you work closely with us over the life of each one. What you can do on your own, though, is to maintain absolutely accurate records in this area. Afixed asset can be considered a tangible item that a business owns and uses to generate income. This can range from machinery and vehicles to any other fixed item used in a business’s operational quest for revenue. It is important to keep a record of fixed assets purchased, as the tax implications may be different for working assets.

In the Asset Information section, describe the item using the Asset Description box or the Notes section. Pick the date of the asset’s purchase in the Date field input. QuickBooks Online is progressive SMB’s top choice for managing payments, invoices, and expenses.

He also wanted to know if it was actually better to incremental cost new vehicles instead because of the extra depreciation potential upfront and having less down time with repairs. For proof that Mark always has at least one foot in agriculture, you might look around his office at home…. There you would find things like a folder of soil test reports, calf obstetrical supplies, a seed sample waiting on a germination test, a stack of machinery parts catalogs…

Step 1. Set-up of the Income Tax Form

A bookkeeper is often tasked with providing clients , with the regular up-to-date financial reporting information. A lot of time can be spent if the balance sheet review includes fixed assets and accounting for deprecation – all of which can be saved once nettTracker is in place. The fixed asset disposal is essential for better management of the balance sheet. It involves recording the fixed asset balances and accumulated depreciation correctly describe all the assets owned by a particular business. If you have any issue consult withQuickBooks USA Supportteam.

Then you can easily tell the book value and accumulated depreciation cost of assets in a few seconds.Go to the Chart of Accounts, and right-click on it, and select the New option. Fixed Asset Manager in QuickBooks Desktop Enterprise is a great feature that allows you to calculate depreciation of fixed assets based on IRS guidelines. With QuickBooks’ FAM, you can enter fixed asset purchases, set up depreciation entries, and even track gain or loss on fixed asset disposal. Fixed assets in accounting is referred to as property that cannot be converted into cash easily and are conventionally cannot be sold to the end users directly. The fixed assets manager lets the users to keep a close account of assets and their depreciation efficiently through an inbuilt automatic process.

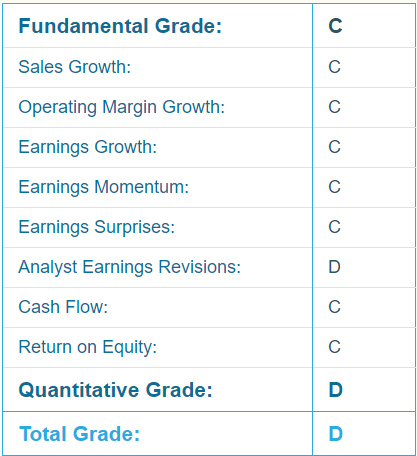

Is Intuit (INTU) Likely to Surpass Q2 Earnings Estimates? — Nasdaq

Is Intuit (INTU) Likely to Surpass Q2 Earnings Estimates?.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Managing the life cycle of your fixed assets is an exception. Fixed assets are physical entities that you purchase to help your business generate revenue, like property, a vehicle or a commercial oven. By definition, they must be in use for over 12 months. Scroll down the item list and select the fixed asset item for this purchase.

A minimal Account Setup is that in which the minimum number of accounts is used. An ideal Account Setup is that in which you can create a separate account per fixed asset. With the asset account, Fixed Asset Manager depreciation in the Depreciation account or Expense account and offset entry on the Accumulated Depreciation account.

Нет Ответов